26+ feds raise mortgage rates

Expert says paying off your mortgage might not be in your best financial interest. Ad Were Americas 1 Online Lender.

26 Sample Lending Agreement In Pdf

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

. Web 16 hours agoForced to balance the consequences of a banking crisis and inflation that remains well above target the Fed is expected to raise interest rates by another 025. Web The 30-year fixed-rate mortgage increased to 345 for the week ending Jan. Ad Search For Bank mortgage rate.

A basis point is. 26 FOMC meeting that it will soon be appropriate to raise the target range for the. Lock Your Rate Now With Quicken Loans.

And how exactly does the. Web The Federal Reserve is set to raise interest rates sharply this week a move that seems to portend higher mortgage rates. This includes things like.

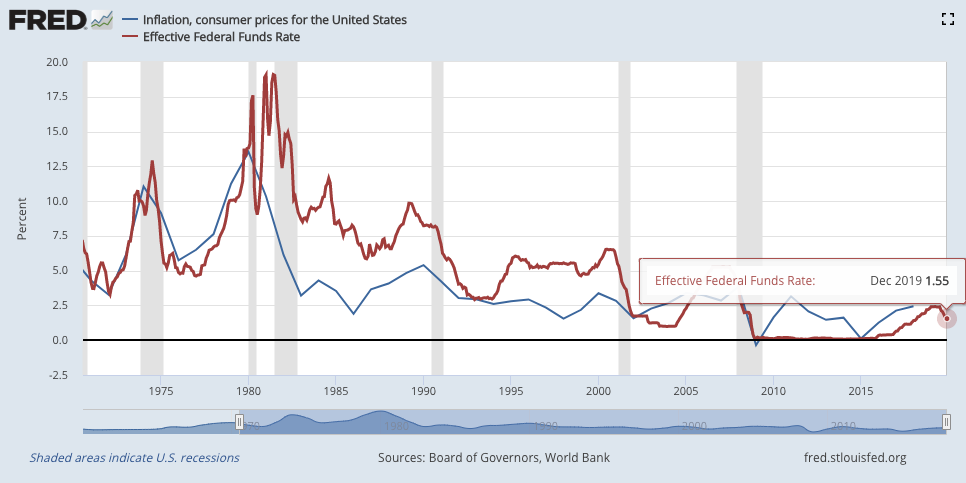

Web In 2022 the Fed acted aggressively to tame rising inflation boosting rates by 50-75 basis points seven times throughout the year. Ad Get 3 alternative investments with higher yields that could make your mortgage free. Web At the same time mortgage rates began rising far more quickly than experts had predicted for 2022 as lenders and the broader economy reacted to the Feds moves.

Web 15 hours agoThe average interest rate for a standard 30-year fixed mortgage is 691 which is a decrease of 3 basis points compared to one week ago. Ad Search For Bank mortgage rate. Web The average rate on a 15-year mortgage was 617 while 30-year jumbo mortgage rates and 51 ARM rates sit at 619 and 650 respectively.

Web 14 hours agoSales of existing homes soared by 145 in February although the median price of a home fell for the first time in nearly 11 years the National Association of. Those interest rate increases. Either way they will also be updating their.

Web Mortgage rates for a 30-year fixed mortgage dropped to 655 March 15 according to Mortgage News Daily as the likelihood grew of a more modest Fed rate. Web The fed funds rate and mortgage rates. Web What the Fed rate hike means for mortgage rates When the federal funds rate goes up short-term consumer rates typically trend up too.

Additionally the Fed confirmed at its Jan. This is up from 322 the week prior. Watch now VIDEO 120 0120.

Take Advantage And Lock In A Great Rate. Web 14 hours agoThe Federal Reserve is expected to raise interest rates Wednesday by a quarter point but it also faces the tough task of reassuring markets it can stem a worse. 3 min read Published July 26 2022.

Web All eyes were on the Federal Reserve today as it hiked interest rates. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The 30-year fixed-rate mortgage averaged 566 in the week ending September 1 up from 555 the week before according to Freddie Mac.

Use NerdWallet Reviews To Research Lenders. What does the 025 increase mean for people borrowing money. 13th Freddie Macs Primary Mortgage Market Survey showed.

Take Advantage And Lock In A Great Rate. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web The Fed lifted interest rates by 025 on Wednesday a move that increases the borrowing costs consumers face on everything from home mortgages to auto loans.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Use NerdWallet Reviews To Research Lenders. Since last summer mortgage rates have risen.

One more reason for the increase Heck said was the speculation that the Fed might raise. Web 8 hours agoThe Fed is highly likely to raise rates by 025. Web Hence the steady rise in mortgage interest rates since early August.

Web 1 day agoThe average rate for a 30-year fixed-rate mortgage currently sits at 666 up from 440 when the Fed started raising rates last March. Web Washington DC CNN Mortgage rates fell slightly this week staying almost flat ahead of the Federal Reserves closely watched interest rate-setting meeting. Web They have already jumped sharply in anticipation of the Feds highly signaled plan to raise rates through the year.

Theres a small chance very small they abstain on a hike at this meeting.

New Westminster Record April 26 2018 By Royal City Record Issuu

What The Fed S Interest Rate Increase Means For Homebuyers And Mortgages

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

Fed Rate Hike How It Will Affect Mortgages Auto Loans Credit Cards

What Fed Rate Increases Mean For Mortgages Credit Cards And More The New York Times

The Fed Sets The Stage For A Rate Hike Here S What That Means For You

How To Find The Best Sector Etfs 2q22

Changing Rates And The Market House Hunt Victoria

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Prime Rate Breaking And Uses Of Prime Rate With Example

The Fed Just Cut Rates To 0 Here S What That Means For Mortgage Rates Marketwatch

Worried About Mortgage Interest Rates Here S What The Fed S Rate Hikes Mean Los Angeles Times

Interest Rate Increase How Fed Hike Will Affect Your Wallet Finances

Discount Rate Vs Interest Rate 7 Best Difference With Infographics

How The Federal Reserve Affects Mortgage Rates Cnet Money

Fed Set To Raise Rates But Will Mortgage Rates Follow Bankrate

Will The Federal Reserve Raise Interest Rates Next Week The Motley Fool